Meetings and events’ demand will grow between 5-10% in 2019, and the average size of meetings will rise in nearly every region, according to the 2019 Meetings & Events Future Trends report, published today by CWT Meetings & Events, a division of global travel management company Carlson Wagonlit Travel (CWT).

“The global meetings and events industry can look forward to a buoyant 2019,” said Kurt Ekert, President and CEO of Carlson Wagonlit Travel. “On top of growing demand worldwide, we also expect global hotel rates to rise 3.7%, and flight prices 2.6%.”

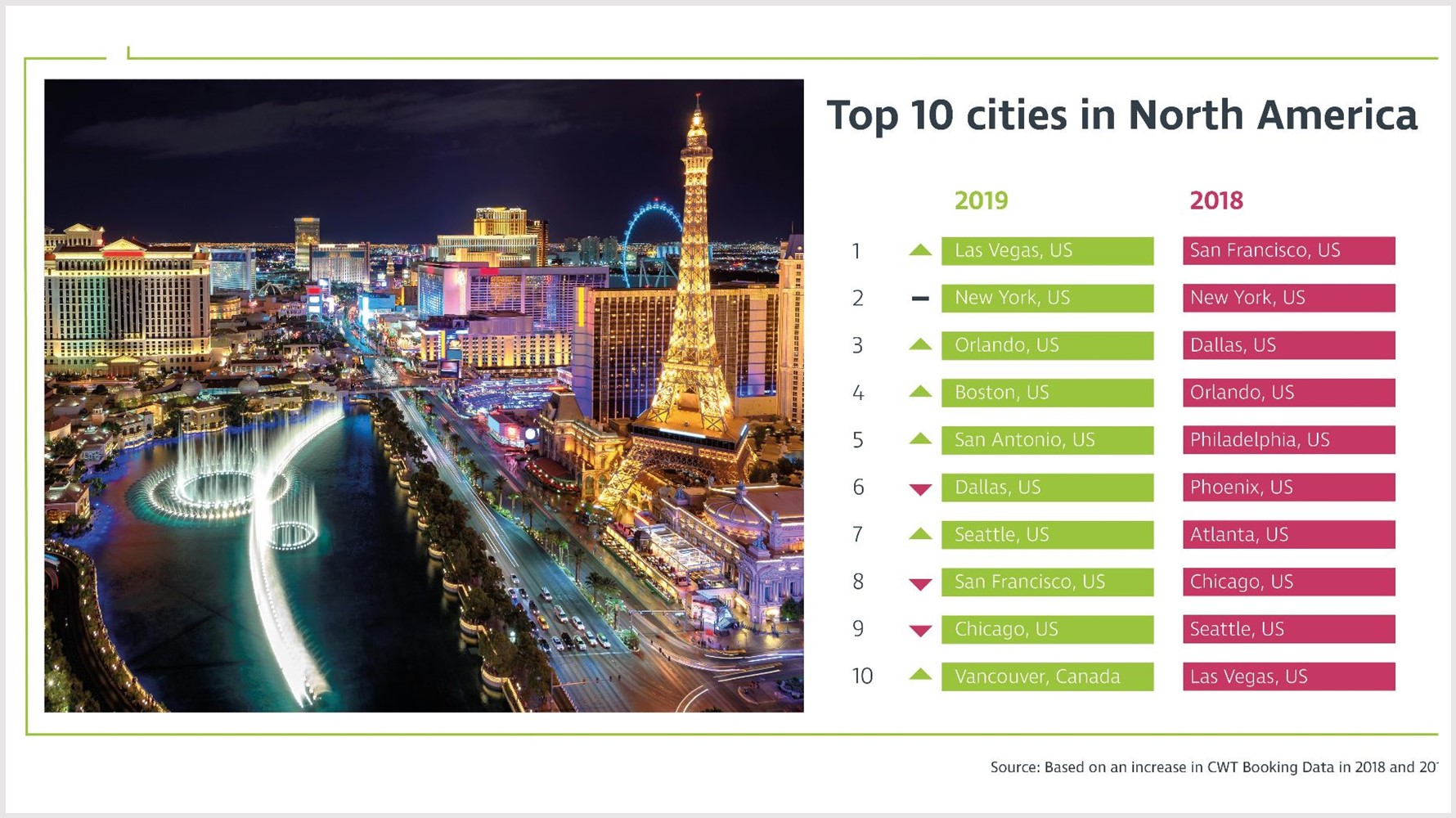

As well as cost projections and a run-down on regional differences, the report also ranks the in each region, and gives an overview of the latest industry trends.

Planning ahead is key. The best time for booking meetings and events activity for small groups is 30+ days out, while for large groups the sweet spot is 75+ days. Outside of these booking windows, buyers are giving up 5-10% in potential savings.

Strategic Meetings Management (SMM) will gain traction in regions outside North America, where it is more mature. The data show that SMM can cut the time spent on sourcing by 22% and deliver an average 19% additional savings on room nights.

“SMM tips the scales back in favor of clients by shifting sales towards preferred suppliers and analyzing demand to work out the optimum times to secure the best venues, hotels and flights – and lock in the best prices,” said Cindy Fisher, Senior Vice President and Global Head, CWT M&E.

Technology will also play a major part next year. Rapid innovation in this space is helping to create more engaging experiences and more targeted learning, while enabling greater data capture and analysis. Augmented reality, virtual reality, artificial intelligence, social media to drive engagement, ad-hoc apps and microsites are some of the technologies that will proliferate across the meetings and events industry.

New technology also creates smarter ways of monitoring ROI and ROE: for example, using data to fine-tune the value around meetings programs, and booking group transport with apps and online booking tools.

These platforms can be integrated into the event’s registration process, giving attendees access to preferred flights and hotels in one place. Managing bookings online, as with general business travel, will also help reduce costs for clients. Another trend for group transportation will be to use suppliers with global reach.

The attendee experience

As well as better technology, there will be a growing demand for unorthodox spaces and activities, particularly in the mature incentive markets in the US and Europe. Suppliers want to make the experience more memorable. Hotels are investing in their meetings and events capabilities. The use of unusual outdoor spaces like treehouses, rooftops and even islands, along with “festivalization,” will be key trends for 2019.

Content will also experience a major shift. 2019 will see further development of new formats: engaging attendees in content creation through questionnaires, and involving them in the identification of topics and choice of speakers. In 2019, those will be less likely to be chosen on the strength of their celebrity status. TED Talks has sparked a whole new way of presenting information, emphasizing knowledge, business insight and emotional connection to the audience.

Regional outlook

- North America: the region’s buoyant economy is driving meetings growth. The market will see a 14% increase in group sizes in 2019.

Tech companies, in particular, are adapting to the demand for more customized, experiential events by holding smaller get-togethers of 20-50 people in multiple cities on a six-monthly loop.

Increasing regulation on transparency in the pharma sector is impacting budgets, but the cyclical nature of the global industry means that some companies – with new product launches – are investing in their meetings and events programs, while those with products coming off patent are looking to make savings of up to 30%.

CWT M&E is forecasting average hotel prices to rise 2.8% in 2019, which will push up costs for meetings buyers.

With the higher price of oil starting to hit airline profits, there will also be some inflation in average flight prices, which are expected to rise by 1.8% in 2019.

- Latin America: the region has experienced a 26.7% increase in average group size, which will decrease by 5% in 2019.

Despite increased positivity, the region’s economic growth is still expected to be relatively slow next year. Hotel prices will fall by 1.3% in 2019, while air prices will drop by 2%.

The recession in Brazil, the largest economy in the region, has led to major global hotel brands dropping properties and local companies stepping in to take their place.

Growth in Argentina is expected to flatten in 2019 following the collapse in the value of the Argentine peso and the country’s securing of a new US$50 billion loan from the International Monetary Fund.

Colombia is expected to be stable in 2019, with year-on-year growth in meetings demand.

In Mexico, the renegotiation of the North American Free Trade Agreement (NAFTA) with the US and Canada is likely to affect the country’s economy.

Peru and Chile continue to see stable meetings demand.

- Asia Pacific: there is a strong growth in the region expected to continue in 2019 with the average meeting size up 3% and China seeing consistent expansion year-on-year.

Vietnam, Myanmar and the Philippines are buzzing as multinational companies establish their presence, with more inbound and outbound travel in these markets predicted for the coming year.

Asia Pacific is expected to lead the way for global growth in 2019. We are predicting airfares will rise by 3.2% in 2019 with hotel rates set to go up by 5.1%.

With such strong growth throughout the region, there is an increased willingness by organizations to spend on meetings and events.

- Europe, the Middle East & Africa: the industry remains positive, with mature European markets demanding enhanced engagement and creativity – making events an ideal showcase for the power of face-to-face in a digitally-focused world.

Airfares in Western Europe are predicted to be the fastest-growing worldwide, with a projected increase of 4.8% in 2019. However, it’s a different picture in Eastern Europe, where rates are projected to decrease by 2.3%, while in the Middle East and Africa there’s a similar downward trend of 2%.

As with airfares, hotel prices in Western Europe are forecast to see the greatest increase of any region globally, rising 5.6% next year. Eastern Europe, will see a 1.9% decline in hotel rates, while the forecast for Middle East and Africa is a 1.5% decrease.

CWT Meetings & Events delivers 38,500 innovative, high-quality projects for customers every year – across all industry sectors, globally. Our creative know-how helps us deliver awe-inspiring events, and our logistics expertise guarantees professional meeting services, group travel, and compliance. We manage your strategic meetings management programs with one aim in mind – to maximize your return on investment.

CWT Meetings & Events is Carlson Wagonlit Travel’s meeting and events division.

Carlson Wagonlit Travel

Companies and governments rely on us to keep their people connected. We provide their travelers with a consumer-grade travel experience, combining innovative technology with our vast experience. Every day, we look after enough travelers to fill more than 260 Boeing 787s and 100,000 hotel rooms - and handle 105 events. We operate in around 150 countries, and in 2017 posted a total transaction volume of more than US$ 23 billion.